Confirmed and potential Indian exhibitors at Busworld Southeast Asia engaged in a fruitful dialogue with Indonesian body builders and policy makers.

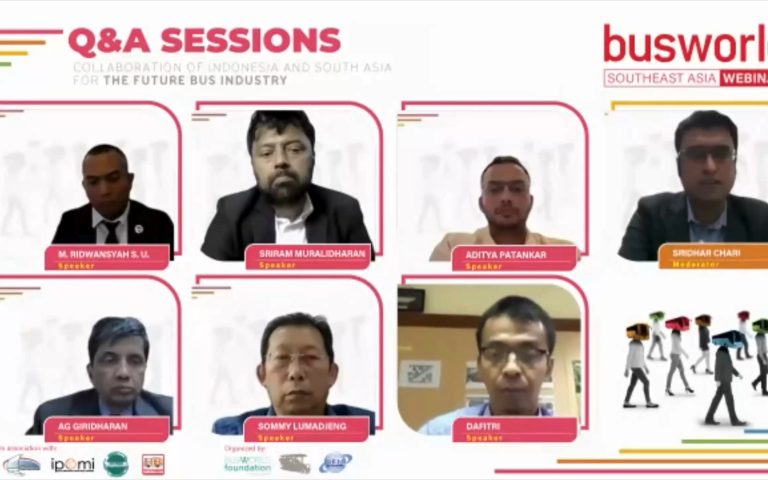

Busworld recently organised the final webinar of a three-part series to build up momentum towards the third edition of Busworld Southeast Asia to be organised from May 15-17, 2024. The theme of the webinar was ‘COLLABORATION OF INDONESIA AND SOUTH ASIA FOR THE FUTURE BUS INDUSTRY?’

In their opening remarks, organisers, Vincent Dewaele, General Manager Busworld International and Baki Lee, Director, GEM Indonesia emphasised that Indonesia’s resurgent bus industry needs collaborations with manufacturers and suppliers from many countries. To this end, South Asia happens to be a key target market. India with its developed bus market and supplier industry, coupled with price-sensitivity would be a good fit for Indonesia.

Keynote Address

AG Giridharan, Deputy CEO, Safety and Comfort Systems, Uno Minda made a keynote address chronicling the company’s two-decade presence in Indonesia including a manufacturing facility. The objective was to enlighten potential Indian suppliers seeking to serve the Indonesian bus market. Established in 1958, the group turnover of the company stood at USD 1.57 bn in 2022-23. It has 73 plants globally, employing 29,300 employees. Uno Minda operates 33 R&D centres globally. Combining its own technology with 19 JV partners, the automotive components major boasts of 26 product lines. Product groups are grouped into electronics and control systems, light metals and power train systems, safety and comfort systems, lighting and acoustics systems. The company is supported by 1,500 suppliers, 35,000 retailers and 72,000 service points.

Giridharan lays out the strategic importance of the Indonesian market by stating that is the third largest two-wheeler market, with sizeable demand locally from global automotive manufacturers, besides being an export base for the ASEAN region.

PT Minda ASEAN Automotive entered Indonesia in 2004 and began manufacturing operations in 2005. When setting up manufacturing operations in Indonesia, the company had little to worry about by way of import regulations and quotas. Supported by a single window submission to the Indonesian BKPM (Investment Coordinating board), Trade Ministry and Customs Department, Uno Minda secured all approvals within 3-4 months.

Dafitri, Plant head, PT Minda ASEAN Automotive, associated with Minda since 2005 has been handling plant operations for the last couple of years. In the initial days, it was a challenge for an Indian company coming via the 100 percent Foreign Direct Investment route, to secure human resources and train them to adopt a global mindset. The Indonesian company has also learnt from competitors and reduced supply chain costs.

In 2008, Uno Minda set up a plant in Vietnam. By 2016, the company was trading automotive seats with localisation occurring in 2021. Uno Minda is now considering an entry into the Indonesian bus market beginning with the exhibition of seats at Busworld Southeast Asia. The company also has a strong suite of electric vehicle products to cater to the emerging demand for green mobility in Indonesia.

Benefitting from a strong local supply base and leveraging its own technology, Uno Minda has been able to achieve 70 percent localisation, much above the Indonesian government’s requirement of 40 percent localisation to qualify for incentives. This achievement enables the company to provide right products of the right quality at the right time and price. The Indonesian market is price-sensitive but demands a higher level of quality and reliability vis-à-vis India. Price-competition with the Chinese being very difficult, the best option for Indian suppliers is to offer better technologically-led value. They can succeed in this strategy by focussing on design and supply chain management.

Indonesia had a population of 2,43,890 buses in 2023, which is expected to climb to 2,71,500 units by 2032. With USD 70 billion being invested in infrastructure, road length is expected to scale up to 18,800 km in 2030, while the Jakarta BRT network will scale up up from 431 km currently to 2149 km, over the same period.

Inputs from the panel discussion

Mohammad Ridwansyah Saidi Ungsi, Director of the Indonesia Investment Promotion Centre (IIPC) in Abu Dhabi, reckoned that Uno Minda’s success story to be ‘music to our ears’.

Both Indian and Indonesian economies are growing at a rapid clip. Indonesia is India’s second largest trade partner in the ASEAN region, trade growing from USD 6.9 billion in 2007 to USD 38.84 billion in 2023. India’s investment in Indonesia has increased from USD 58.3 million in 2019 to USD 191.5 in Q3, 2023

35 global trade agreements have been concluded and implemented making Indonesia a production base for the global market. Tariff rates for 96 percent of traded products among ASEAN countries are zero enabling free mobility of capital and resources in the region.

Indonesia is ASEAN’s largest economy and projected to be the world’s 7th largest economy by 2030. It is the fourth most populous country in the world with a 50 percent working age group and a rapidly growing middle class with disposable income.

The Ministry of investment through BKPM provides end-end services, from promoting investment, bridging potential partners and related stakeholders, assisting through procedure and licensing process, assisting financial closure, to facilitating redressal of hurdles until production stage. BKPM has 9 investment offices in Abu Dhabi, Singapore, Seoul, Tokyo, Sydney, Beijing, New York, London and Taipei.

The Ministry is committed to ease of doing business in Indonesia and liberalising more sectors for foreign investment. Where earlier, it took 3-4 months to get approvals, now companies can make online single window submissions from anywhere at any time. Instead of a negative list, Indonesia now have a positive list or priority sectors, where the government would like to seek investments.

The priority list extends to 245 business fields, partnership with local Small and Medium Enterprises to 46 fields, 60 fields are reserved for local SMEs. Foreign ownership limitation, (JV with local companies) has been reduced to 37 fields from 350 previously. BKPM has identified 69 ready-to-invest projects.

The basic requirement for foreigners to invest in Indonesia, is that the minimum investment and paid-up capital should be at least USD 700 thousand, while complying with the priority list for investments.